What To Know About Trump’s New Student Loan Forbearance Orders - Page 4

Share the post

Share this link via

Or copy link

Source: Chip Somodevilla / Getty

President Trump recently signed an executive order extending financial relief for borrowers of Federal student loans until the start of 2021. Any time new financial assistance becomes available of any kind – student loan or otherwise – it’s important to become familiar with the fine print, know who is eligible, and understand the potential downsides. Just because aid is available to someone doesn’t mean it’s the right thing for them in their particular situation. And with so many new orders being reported on a nearly daily basis, it can be hard to keep up with what’s going on.

Student loans can be such a stressful topic, and such an overwhelming burden, that the emotional fog surrounding it can make it hard for borrowers to clearly assess how to move forward when new aid programs arise. I spoke to Sonia Lewis, CEO of The Student Loan Doctor, about what borrowers should know about Trump’s recent executive orders surrounding student loan relief.

Source: valentinrussanov / Getty

Given the times, it’s appropriate

With some industries picking back up, some salaries being restored, and small signs of economic hope, many borrowers may think they don’t need to use the extension. But Lewis notes things are far from over, saying, “People can benefit from the extension. We are technically still in a pandemic. Things are not normal for people in the workforce. The extension is needed but be wise with how you use the extension.”

Source: John Lamb / Getty

If you can pay, pay

Love MadameNoire? Get more! Join the MadameNoire Newsletter

We care about your data. See our privacy policy.

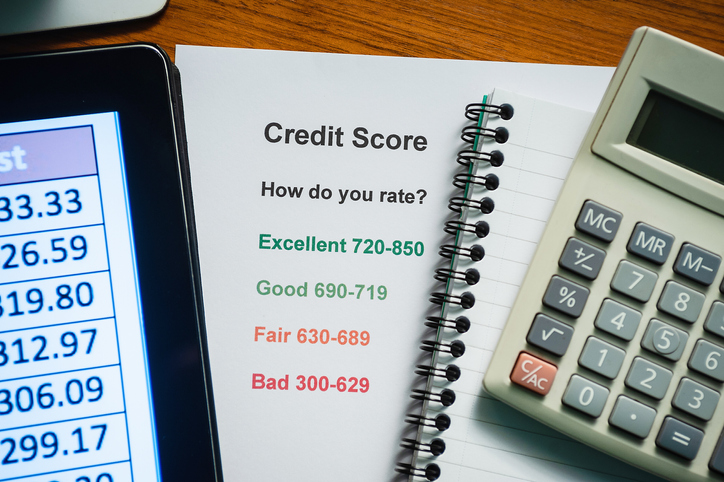

Those who need to defer payments in order to have cash for essentials like rent or groceries should likely take the relief, but Lewis encourages those who can pay, to pay, for two reasons. The first being that, “Any time you pay your loan, you see that as a boost in credit the next month.” One exception Lewis brings up – and it’s certainly not for everyone – is that, those who have an opportunity to invest that money at a higher rate than they’re borrowing it, may consider that. Again that is only if they don’t need it for essentials.

Source: bojanstory / Getty

Pay now to pay less later

The second reason Lewis encourages those who can pay now to pay is that, right now, for students who took out loans this year, interest is not accruing, so it’s a great time to pay down that principal so that when interest rates do resume, that interest is on a smaller principal amount. This can make the overall loan amount more manageable, once interest begins to accrue again.

Source: Grace Cary / Getty

Income-driven repayment plans

Income-driven repayment plans or IDRs are something Lewis recommends borrowers looking into and seeing if they qualify for. These are designed for professionals in lower-salary jobs and, as the name suggests, base repayment terms on one’s income. There are four types of IDRs, and each one offers loan forgiveness after a certain number of qualifying payments, and will ensure that your monthly payments do not exceed a certain percentage of your income.

Source: Barcroft Media / Getty

These can help, now and always

With many workers having taken pay cuts due to the pandemic, it could be worth it to look into these IDR plans and see if one may relieve borrowers of some of their burden, though Lewis notes changes might be in play that reduce the four types of plans down to just one type, so there could be fewer qualifying borrowers.

Source: SDI Productions / Getty

Public service loan forgiveness programs

Public service loan forgiveness programs offer those burdened by student debt a way to be forgiven of that debt. In most cases, the borrower must make 10 years of qualifying payments, while working full-time in a public service career, and then may see the remainder of their debt forgiven. For now, those with a Direct Loan who have been on track with payments will receive credit during the suspension period.

Source: SEAN GLADWELL / Getty

Private loans are exempt

At this time, only federally held student loans are eligible for coronavirus forbearance. Private student loans, as well as private parent loans, are not eligible for deferment due to coronavirus. That being said, many lenders offer income hardship forbearance that offers deferment plans in times of economic hardship, whether that’s due to the pandemic or something else, that could be helpful to those with private loans.

Source: Richard Baker / Getty

Be on the lookout for changes

Lewis states that there are a lot of proposed changes happening that could impact many types of loans. Changes may be coming that impact whether or not those in the Public Service Loan Forgiveness Program will be eligible for pandemic forbearance. Some changes are being proposed that would exclude Parent Plus loans from income-driven repayment plans, or from parts of those plans. “Pay attention to the different proposed changes that are coming with repayment in general,” says Lewis.

Source: SDI Productions / Getty

Keep your federal loan

Lewis warns borrowers that many lenders may be offering attractive rates, tempting borrowers of Federal loans to transfer their loan to a private one. But Lewis says that making that change would mean the borrower was no longer eligible for coronavirus forbearance programs, as those are only for Federal loans.

Source: Catherine McQueen / Getty

Federal is better for the future

Many of the low-interest private loans being offered to potential refinancers are also variable, so they could change, whereas interest rates on Federal loans are far more stable. And, Lewis reminds borrowers that, there may be other times in the future when they may need economic forbearance programs but, once again, having a private loan would likely make them ineligible for those.

-

Meet Dominique Fils-Aimé, The Haitian-Canadian Star Redefining Jazz For A New Generation: ‘This is My Vision' [Exclusive]

-

Cooking With Purpose — How Brittney Williams Honors Her Caribbean Roots Through Food

-

Bucket Baddies With Big Energy — The 30 Hottest NBA Players In The Game Right Now

-

8 Famous Lesbian Women Who Were Married To Men