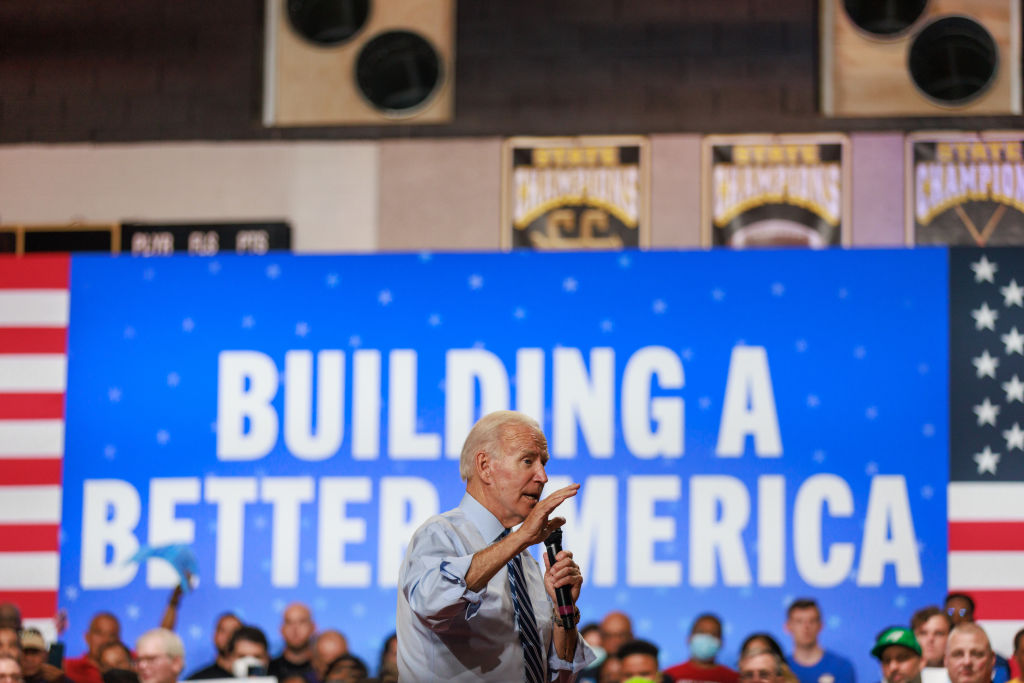

Source: Anadolu Agency / Getty

Some student loan borrowers gave a communal sigh of relief when Biden’s plan to forgive massive student loan debt was announced. The predatory nature of student loans of previous generations has come to light. Millions of students – particularly of the millennial generation – took on huge loans to go to college, with little guidance or explanation as to the implications of that debt.

CNBC stated that nearly 70 percent of millennials were still paying down student debt, more than a decade after graduating college. For many, those hefty monthly student loan payments have stood in the way of saving for a home, or simply creating an emergency fund. They’ve been an undeniable burden on the shoulders of millions of Americans and now, a lucky group is about to feel a whole lot lighter. Here’s everything you need to know about Biden’s student loan forgiveness. For complete information visit StudentAid.gov.

Which Loans Are Eligible For Forgiveness?

Any loan held through the Department of Education is eligible for forgiveness. This includes subsidized unsubsidized, graduate and Parent PLUS Loans.

If you used your loan for something other than a bachelor’s degree, such as community college, a trade program or an alternative certification, your loan will still qualify.

Federal Family Education loans (FFEL) might be eligible. These were private loans that were subsidized and guaranteed by the U.S. federal government and dispersed from 1965 to 2010. If your FFEL was eligible for the loan repayment pause during the pandemic, it is likely eligible for forgiveness. The Department of Education is currently working with private lenders who hold FFELs to negotiate forgiveness – but this will take some time.

Which Loans Do Not Qualify?

Private loans, such as those held by third-party private lenders like Sofi, Earnest and Discover do not qualify for forgiveness. An easy way to know if you will qualify for forgiveness is to check and see if your loan qualified for payment freezes during the pandemic. If it did not, then it likely will not qualify for forgiveness.

Source: Igor Alecsander / Getty

What If You Haven’t Completed Your Degree?

If you did not finish your degree or are still in school, you are eligible for forgiveness so long as you hold one of the eligible loans. However, the loan must have been dispersed before June 30, 2022 to qualify.

What About My Next Payment?

Since this forgiveness won’t go into effect right away, many borrowers are left wondering what to do with that next student loan bill. Biden has extended the student loan repayment freeze that’s been in effect since March, 2020 through December 31, 2022. This is to ensure a smooth transition into the loan forgiveness program.

Who Qualifies?

Individuals making less than $125,000 per year who also received a Pell Grant (educational grants given to those in extreme financial need) can qualify for up to $20,000 in forgiveness. Individuals who make less than $125,000 per year but did not receive a Pell Grant can qualify for up to $10,000 in forgiveness.

Public servants will also be eligible for additional help. This includes those who have worked for the military, a nonprofit, federal, state, tribal or local government. The Biden administration is still working out what level of forgiveness is commensurate with these individuals’ contributions.

Source: Marko Geber / Getty

Will It Be Automatic?

For some borrowers, yes. If the Department of Education already possesses your income information, you can see the forgiveness reflected in your balance very soon. Others will need to submit an application, which the Department of Education says will be available early October. Those who must submit the application in October can expect the forgiveness reflected in their balance within four to six weeks after submitting their application.

Income-Based Payments Will Be Reduced

In addition to the loan forgiveness, part of Biden’s new plan to reduce student loan costs also involves a cap on income-based payment plans. In previous years, borrowers on these plans paid 10 percent of their income on their monthly payments. This rate will be cut down to five percent.

Will I Pay Taxes On The Forgiven Debt?

Not on federal. Under the 2021 American Rescue Plan Act, forgiven loans are exempt from taxation until 2025. However, some states will require state income taxes on the forgiven debt. Check here to see your state’s legislation.

RELATED CONTENT: Biden Administration Extends The Student Loan Moratorium To End Of August